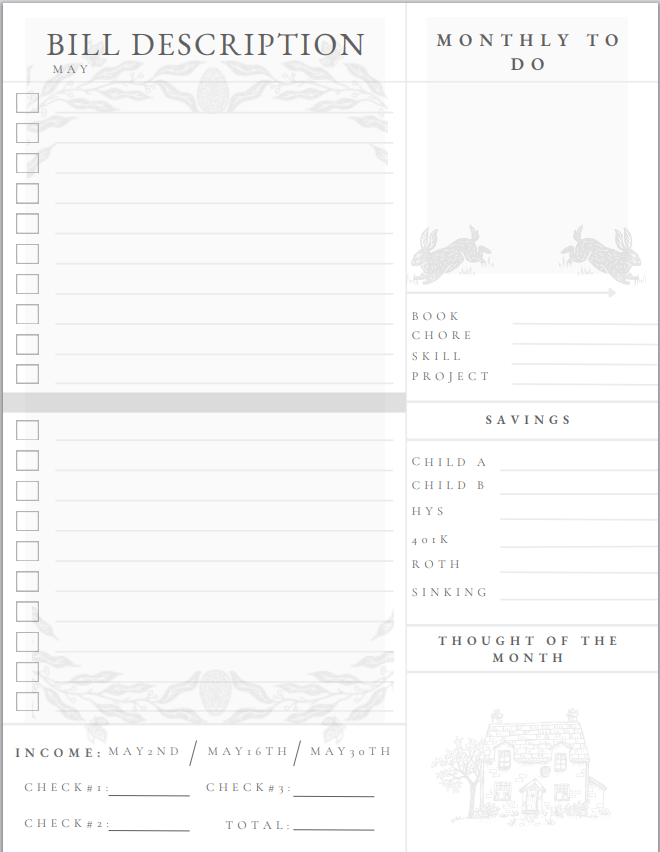

Above is an example of the editable monthly budget template that I designed in Canva. This is a digital rendition of the template that I have used myself for the past few years. I used a resume layout and modified it to match my hand drawn monthly template. If the downloadable budget template won’t work for you I recommended using Canva and altering a resume template to fit your needs. It’s free and it took me just a few hours to complete.

As you can see I in the top left panel I have my bills separated into two distinct areas, based on my bi-weekly paycheck. Half of my bills are paid the first part of the month, the rest the second half of the month. I write down what my expected bills are, and what I expect to pay and then what I actually pay. I balance my budget by expecting to pay at the higher end – if the bill is less than my higher estimation then I consider it a bonus and shift the extra money into savings. For the most part my bills are consistently the same, and I try to lock in a long term rate instead of a variable rat if the option is available. I prefer the consistency of say, knowing my gas bill will be $100 a month for the year instead of being cheap in the summer and expensive in the winter. If I am unable to lock in that rate I budget high rather than low.

If all your bills fall at the same time of the month see what bills can be paid earlier, my electric bill is due around the 15th but I always pay it with the first check of the month. If you are able to, change your payment due date to one that fits your pay period. Some companies allow you to adjust when your payment is due, and many mortgage companies will allow you to pay your mortgage payment in two biweekly installments – absolutely do this if you can. It will be an inconvenience the first month to do this, and there may be extra cost up front, but moving forward breaking one large chunk into two more manageable amounts will decrease the stress from a feast or famine cycle and having biweekly payments on your mortgage will easily allow for that extra yearly payment without hurting your budget.

I personally don’t categorize every dollar spent into various categories like some suggest; i.e. separate categories for groceries, car expenses (beyond insurance), toiletries, pets, entertainment and so on. I found it tedious and lot of unnecessary extra work. Anything that is bought from a store, becomes the “grocery budget” which broadly falls under my credit card bill (I’ll explain this in the next paragraph). That doesn’t mean that I don’t budget for my grocery items and entertainment, what it does mean is that I don’t nickle and dime every purchase. I monitor regularly what is spent and keep it below a set limit. I just don’t micromanage my budget needlessly. If you are just starting out and have zero idea what you are spending a month, micromanaging might be a good idea for a few months to get a clear idea where exactly your money is going. After time, and developing healthy spending habits, I would reflect on if you still need to itemize every penny into 20 different categories. Micromanaging your spending can be just as unhealthy as disregarding your spending.

There is something else that I do that goes against A LOT of budget gurus, I own and use a credit card for all purchases outside of my monthly routine bills. I have one “family” credit card account. Every family member is an authorized user and has their own card for the account – this includes my teenager as well. All expenditures beyond routine bills go onto this card. We set a budget for that credit card and stick with it for the most part baring unavoidable situations, i.e. a car needing hefty repairs. I get notifications for every purchase on this card and routinely check the balance so I know where we are in spending vs. our budget.

What I do differently than most people is that I treat my credit card as a routine bill and pay the full balance of the credit card every two weeks. In unavoidable cases such as car repairs, I transfer money in from my high yield savings (HYS) and STILL pay off the bill in it’s entirety. If you are not able to pay the entire bill off every two weeks do not use a credit card of any kind. I say this because the accrued interest will avalanche on you into a mighty financial mess in a very short period of time. Until you can build the habit, as well as an emergency fund to cover surprises, using a debit card would be the safest financial route.

Why do I use a credit card instead of my debit card, or cash? There are several reasons first, there is my personal cash dilemma. If I have cash in hand, I am more prone to spend it on things I don’t need, ahem…Facebook marketplace. I also never understood the need to carry hundreds of dollars around. I am afraid I would either lose it or become a victim of robbery. Lastly, our society is increasingly becoming a cashless society – many places no longer even take cash, and I rarely frequent any place that doesn’t accept cards. In regards to using a debit card, yes I could, but I have gotten in a habit of “zeroing out” my checking account when I get paid. All bills are paid, including the credit card and everything else goes into saving down to about $20-50. Could I do this with my debit card – yes, I could, but I personally would always feel on edge about going into the red – especially with two other card users in the family. Finally, my credit has cash back which in the past I typically applied to lower my monthly bill – this year I am trying to hold off on using the cash back to see if I can pay for the majority of Christmas shopping.

There are many benefits and offers with credit cards. Be wise with them – pay them off every two weeks, don’t get one with a fee, and review which ones give you the best rewards. My last bit of advice is to keep how many you have down to just a few. I personally have too many, I use two exclusively – our family card and Tractor Supply card but I have several more that I wish I didn’t have and am patiently waiting for them to be cancelled for lack of use.

Back to the print out. Below the bill description panel is a section where I record the amount of each paycheck, when I can expect to get paid and the total monthly income. We are a single income family, and I am an ER nurse, so my pay varies from paycheck to paycheck based on when and how often I work. On the downloadable PDF this area will be modifiable so you can adjust to fit your needs.

Since I review my budget book often, at minimum once a week, I have designed the right column of my budget planner to include major monthly tasks, goals and motivation as well as a place to track my savings for the month. I personally don’t have monthly planner beyond my budget book and our family Google calendar. So this works well for me.

I have included a savings area, which is modifiable to fit your needs. I treat saving as a biweekly bill so that I ensure something, no matter how small, goes into savings. When building this print out I tried to incorporate the typical saving strategies used by most people but these are not exactly what I use. I personally have a HYS account for each of my children, and an emergency/savings fund. I do not use a traditional bank for savings, there is zero growth to putting savings in a radiational account. A HYS account, while the rate fluctuates will have always bring you some growth. Each child gets a set amount into savings every two weeks, the emergency fund is dependent on what is left over from the budget. Again, my savings – especially for my children, become a routine bill. I have a 401B through work, but since that money is taken directly out of my check I don’t include it in my budget. (I plan to create a wealth tracker print out/spreadsheet where you will be able to track things such as 401k, Roth, house value, ect.) I also have a very small Roth, which I don’t regularly contribute to so I don’t track it on my monthly budget. In the future I plan to contribute more to a Roth but at this time my savings goals are very specific – I want a farm, and have to save for a down payment on that, so all extra savings, beyond my kids, are going into a HYS specifically for that goal.

What I would like to address which I think a lot of the budgeting gurus miss is that you have to modify your budget to fit your needs and your goals. The steps are great, the plans are effective but how can I save for everything under the sun, plus pay bills, plus put money into a HYA, Roth, HSA, 401K, college 529, sinking fund, emergency fund, and whatever else is out there. Am I doing it correctly, by the book according to these individuals. Probably not. Our family doesn’t make $100K a year and I certainly can’t tie up almost $35,000 into savings for decades just bring my yearly income / taxes down. My family makes enough to live comfortably, pay our bills and add a little bit to savings. I honestly feel that is where most people sit at this time – getting by and making do while trying their damndest to get a little bit ahead. And, that’s okay to be there. Just keep budgeting, living frugally and saving.

In the downloadable PDF I have left several of these areas blank so they can be modified to fit your personal needs including the month, goals, and savings. You can either type in and print, or print out and hand write in the blank areas. I am also including a Canva editable template a well. It seems to be a little tricky in that you will have to “share” the link and then open it in a new tab. As I newly navigate both Word Press and Canva I will make modifications to upload ease as I learn how to deliver it.